November 9, 2019

Diversity in Investing

To invest is to devote to a particular undertaking with the expectation of a worthwhile result. Many people think investing is a risky business, but in reality, we invest every day of our lives. We invest time to our career growth, we invest energy into our relationships, and we invest money in our livelihood.

When we invest local and invest in a community we care about, the dividends come back in more ways than one. We empower ideas and improve the economy.

Historically, diversity in investing has only been achieved in diversifying assets. As of late, diversity is growing into all parts of investing. Hear from four investors who took part in our recent Twitter Chat Launch Hour. Panelists included Marnie and Lindsay from Launch NY, as well as the founder of Women Who Tech, Allyson, and Chief Innovation Officer at University of Maryland, Julie.

Panelists include: Lindsay Karas, Marnie LaVigne, Julie Lenzer, & Allyson Kapin

Allyson: I’m Allyson Kapin, founder of Women Who Tech and cofounder of Rad Campaign, a social change web agency.

Marnie: I’m Marnie LaVigne, President and CEO, Co-Founder of Launch NY.

Lindsay: Lindsay Karas Stencel, COO and Fund Manager of Launch NY.

Julie: I’m Julie Lenzer, recovering entrepreneur, former Obama appointee, and now Chief Innovation Officer at University of Maryland.

How did you get started in investing in startups?

Allyson: It’s BS that only 2.2% of investor funding goes to women-led startups. And for women of color it’s even more dismal at 0.2%. So we decided to do something about it.

Marnie: I was part of two IPOs, one spun out of @UofR and one as part of the .com boom in NYC, based on my doctoral work in health IT back a few short years ago J so I brought that firsthand experience to help build the #lifesciences and startup ecosystem in WNY.

In my role leading tech-based economic development at @UBCommunity, I saw the power of small, but mighty dollars whether in the form of grant or investment capital in my work with startups. #LaunchHour

Paired with colleagues from @WNYVA and @ECIDANY who heard the story of VDOs like @JumpStartInc and @InnovationWorks, we knew Upstate NY needed the same model of mentorship and seed capital. #LaunchHour

This model of mentorship and seed capital helps prevent our startups from dying on the vine or moving to more fertile communities, and this was especially true for underrepresented company founders who lacked connections to the small pool of local investors. #LaunchHour

Lindsay: I started as an associate and legal counsel for @NCTventures out of Columbus, OH where we invested in 44 companies through its family of #Venture Funds. I also run my own law firm and invest in startups personally.

Julie: I started investing in @startups after selling my company. After teaching the ACTiVATE program, I realized how disparate the funding was for #women.

What changes have you seen in the venture funding ecosystem as it pertains to diverse investors?

Allyson: The good news is that we’re seeing more diverse investors and more diverse-led funds. The bad news is we’re still not moving the needle because women and people of color aren’t getting funded nearly enough and we’re squashing innovation because of it.

Marnie: At Launch NY, we broke new ground as the only nonprofit VDO – exclusively female led at that – serving all startups across our entire region.

We were fortunate that Christine Whitman and Theresa Mazzullo paved the way in their investment activity in early stage investing in the #Rochester area.

We are among less than 5% of venture capital organizations who have a women-led fund. Our COO and Fund Manager, @LKSLaw has helped led the growth of its Seed Fund to become the most active seed fund in New York with a close rate of 2-3 investments per month.

When it comes to minority-led investors and investments in our region we’re proud of our portfolio but know we can do more.

We are engaging with more minority mentors and investors, and we are leveraging our CDFI partnerships to connect with more minority-led entrepreneurs who might have a big idea but weren’t sure how to pursue it.

What are some unique challenges that diverse founders face generally when it comes to seeking investment?

Allyson: It can be an uphill battle for diverse founders to raise funding. We conducted a survey with nearly 1000 founders and found that 44% of women founders were harassed.

77% experienced sexist harassment. 45% experienced sexual harassment. 65% who were sexually harassed were propositioned for sex in exchange for funding, introductions, a job, etc.

Lindsay: Typically GPs in #venturefunds are predominantly white male. This often creates an inherent, and often unintentional, bias which results in mainly white males receiving funding.

The challenge is to find funds that seek out diverse founders and teams. There are many out there, it just requires a little bit of a deeper dive.

A #Pitchbook report revealed that $40B raised by #vc firms, less than 3% is allocated to minority-owned startups and only 2.2% went to female-founded startups in 2018. What can we do to level the playing field?

Allyson: It’s simple. Be intentional fund & diverse-led startups. This is not about altruism. It’s about funding innovative startups that reflect our global economy and are meeting mass market demands. Stop leaving money on the table.

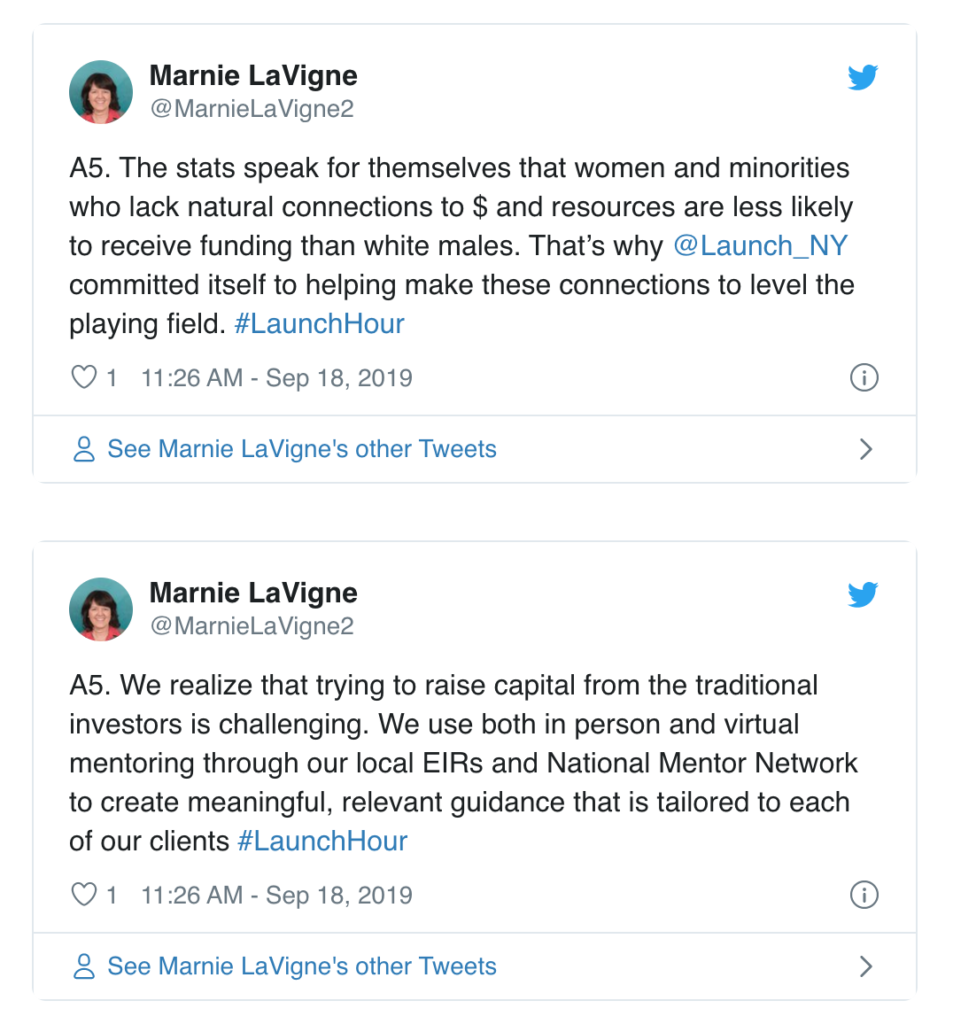

Marnie: At Launch NY, we are proud to have 33% of portfolio companies being women-led and 21% minority-led.

Our nonprofit model has meant that we can offer robust, tailored, pro bono resources that solve the same kinds of challenges all startups face, but also directly tackle the concerns of underrepresented entrepreneurs.

Consider @GRASPIE, a minority-owned business with a workforce training app in which we invested in in 2018.

Derrick had been engaged with a debt financing program that is more typically used by Main Street businesses, so @Launch_NY invested in GRASPIE and we stepped up on our work to help him restructure this loan to make the business more attractive for equity capital.

One thing we’ve learned is that you have to be really intentional about leveling the playing field or else investors tend to gravitate to the usual ways and channels for identifying and funding companies.

Lindsay: More women and diverse venture funds and GPs will help to close the gap. All VC funds acknowledging the potential biases in their decision making and seeking to overcome it will also be helpful!

What are some lessons learned you could share from investors perspective for first time founders?

Lindsay: Encourage founders to seek out advice from people who have done it before them. Building their network and circle of people who can provide advice, offer a shoulder to lean on or possibly offer connectivity to customers or investors is insanely important

Marnie: Tap into the resources that we offer. To date, @Launch_NY has mentored more than 1,000 startups across Upstate NY. From mentoring from a handful of mentors starting in 2012, we have grown to more than 27 local, experienced EIRs today with increasing diversity.

Through their expertise, combined with the addition of the National Mentor Network of 2,000 industry, business and investment experts, our pro bono support brings a wealth of experience, guidance and connections designed to make startups investment-ready.

You also can access all of our digital tools on our website. We have an entrepreneurs tool kit, resource network, and much more for first time founders.

And be inspired by our diverse entrepreneurs leading our client companies including @GRASPIE @RachelsRemedy @perfectgranola @EcolectroInc @eatme_icecream to name a few!

Julie: Where possible, first time funders should focus on customer validation and acquisition. Early revenues are hard to come by in some industries, so non-dilutive capital like #SBIR can provide solid options for tech development.

What would you tell someone who is looking to get into investing in startups?

Allyson: If you want to become an investor, immerse yourself in the space. Read books, blogs, and talk to everyone you can to learn the ins and outs of investing.

Marnie: Launch NY’s new #investlocal programs are designed to help first time investors benefit from the mentorship, due diligence, and deal leadership we provide.

On Thursday, September 26 our team will be in #Binghamton at the @ST_Startup #Koffman Incubator for a panel discussion on the path to investing in startups

Lindsay: Invest Local! Fostering the entrepreneurial ecosystem in an area you live in or care about is insanely important! Startups create new sectors and new jobs, which build the economies that matter to you!

Check out the @LaunchNY investor network if you are interested in investing in Upstate NY startups!

Julie: Find a mentor! Attend lots of “pitch days” and hear what the experts are providing as feedback.

Learn about local investment opportunities!

Tag: Diversity in investing, Women-led startups funding, Minority-led startups, Investing in diversity, Venture capital diversity, Female entrepreneurs investment, Startup funding for women, Diversity in venture capital, Launch NY investing, Inclusive investment strategies, Seed funding diversity, Diverse founders venture capital, Equity in startup funding, Investing in women tech, Diverse investor networks.